florida sales tax on boat repairs

3 with a tax cap of 1500 New York. Taxpayer requests confirmation that.

Florida Sales Tax And Outboard Engines Macgregor Yachts

Are Services Taxable in Florida.

. Florida boat dealers and brokers are required to collect. A new Florida law that takes effect July 1 limits the sales tax paid on repair and renovation of a boat to 60000 or the first 1 million of. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

In addition no shipping charge can be taxed if. Foot sloop doesnt use extended journeys or a celebration of 4 for day cruises and do it comfortably. The absolute maximum tax you can pay on the sale of a boat or vessel in the state of Florida is 18000 as of 2018 state tax rates.

State B welcomes you to the state but weeksmonths later State B eventually sends you a. To speak with a Department representative call Taxpayer Services at 850-488-6800 Monday. The maximum tax on the repair of a boat or vessel is 60000.

Department of Revenue Florida Department of Revenue DOR 02-9-FOF December. Related the maximum tax Florida requires on the repair of a boat or vessel is 60000 for each repair with separate or subsequent. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665.

The maximum tax on the repair of a boat or vessel is 60000. You decide to take your boat to State B. 5 with a tax cap of 15400 Michigan.

A few other popular boat-buying states taxes are. Beginning July 1 2015 a dealer should not collect tax in excess of 60000 on a single repair. When shipping the vast majority of items you do need to charge sales tax in regards to the shipping charge.

The bill was based on a 2010 law that capped Florida sales tax on the purchase of boats at 18000 or the first 300000 of the sales price. FULL_GIRL 03092013 at 132345. To start with under the laws of the Florida Department of Motor Vehicles DMV every carboatplane must be registered with the DMV.

Floridas Sales and Use Tax GT-800013 Floridas Discretionary Sales Surtax GT-800019 Florida Annual Resale Certificate for Sales Tax GT-800060 Information forms and tutorials are available on our website. 789_22_57 03092013 at 103849. If youre in the market for a boat valued at 300000 or more.

The maximum tax on the repair of a boat or vessel is 60000. Find your CA Rate by address or by location. Boats Imported for Repair If sales or use tax has not been paid on a boat the boat is exempt from tax if it remains in this state for a maximum of 20 days in any calendar year.

Subsequent and separate repairs are each subject to their own 60000 cap. When the purchaser does not pay Florida sales and use tax to the seller for a boat purchase any sales and use tax plus any applicable discretionary sales surtax is paid to the county tax collector licensed. Varies between 7 to 9 on purchase depending on homeport plus personal property tax may also be due.

Sales and Use Tax on Repairs of Boats or Vessels Capped at 60000 Effective July 1 2015 the maximum tax due on each boat repair transaction in Florida is 60000. E Within 30 days of removal the purchaser must provide DOR with written proof that the boat was licensed titled registered or documented. An Overview of Florida Sales Tax Law.

That law helped boost boat sales and increased sales tax revenue for the state and now the hope is. Join 16000 sales tax pros who get weekly sales tax tips. Advisement 03A-051 Importing Boats Into Florida Solely for Sale in our online Tax Law Library.

12A-1071 Florida Administrative Code FAC QUESTION. With marine-related competition for the repair and refitting of vessels now heating up in the Caribbean Latin America and Europe MIASF has taken an active role to ensure that South Florida. Sales and Use Tax TAA NUMBER.

We can help clarify the existing tax laws and point you in the right direction. For instance assume you paid tax on your 100000 boat purchase to your home state at a 6 rate or 6000. Subsequent and separate repairs are each subject to a 60000 cap.

This tax cap law went into effect July 1 2010 and is still in effect today. This cap is to be applied to each boat. 21221 Florida Statutes FS RULE CITES.

Currently Florida has a sales and use tax for boats which is set at 6 of the purchase price. If youre considering purchasing a boat MacGregor Yachts is your first step. Give us a call to get in touch with our knowledgeable and friendly team at 561 799-6511 or contact us through our website.

4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. Are Services Taxable in Florida. All boat sales and deliveries in this state are subject to floridas 6 percent sales and use tax unless exempt.

Floridas general state sales tax rate is 6 with the following exceptions. The maximum tax on the repair of a boat or vessel is 60000. Taxpayer provides yacht charter services with crew furnished by the owner.

All boats sold andor delivered in this state are subject to Floridas 6 percent sales and use tax unless specifically exempt. This figure includes all sales and use tax plus discretionary sales surtax. The maximum tax on the repair of a boat or vessel is 60000.

Sales and Use Tax TAA 17A-012 Boats. Fl sales tax 60k cap on boat repairs published december 7 2018 by david j. The Internal Revenue Service may audit the dealer and hold the dealer responsible for the sales tax if such amounts are not collected from you at the time of sale.

It is commonly known that tangible personal property is taxable in Florida. Sales and Use Tax TAA NUMBER. All boats sold delivered used or stored in Florida are subject to Floridas sales and use tax plus any applicable discretionary sales surtax unless exempt.

Tangible personal property is defined as personal property that may be seen weighed measured touched or is in any manner perceptible to the. The sales tax on shipping does not need to be charged if the charges are both optional and stated separately. Many counties impose a local surtax on the first 5000 of the sales price.

TMW Yacht Sales Inc. However Florida caps the total tax amount due on a vessel at 18000. The 20-day period is calculated from the.

Florida charter boat exempt. All other activity with the boat including its movements for boat shows and repairs were considered to be in the scope of bare boat operations. The state of Florida imposes a tax rate of 6 plus any local discretionary sales tax rate.

Repairs purchased outside Florida. This cap is to be applied to each boat repair. Much more enjoyable florida sales tax boat repairs to observe custom unstable at larger speeds being one piece it may be better.

The state of Florida has very simple rules when it comes to taxes on shipping. Signed into law by Governor Scott the 60000 tax cap eliminates sales taxes on boat repairs that cost more than 1 million starting July 1 2015. Current Tax Law How You Can Benefit.

Fort Lauderdale Boat Sales Service 954 926 5250 Nautical Ventures Nautical Ventures

Scarab Boats For Sale In Miami Fl Scarab Jet Boat Dealer

How To Get A Title For A Boat With A Bill Of Sale Legalzoom Com

2019 Yamaha Sx195 Riva Motorsports Miami

Used Boats For Sale In Miami Fl Used Boat Sales

Duncan S Boats Lowcountry Family Boating In North Charleston Sc

Florida Marine Boat Services And Dealers For Sale Bizbuysell

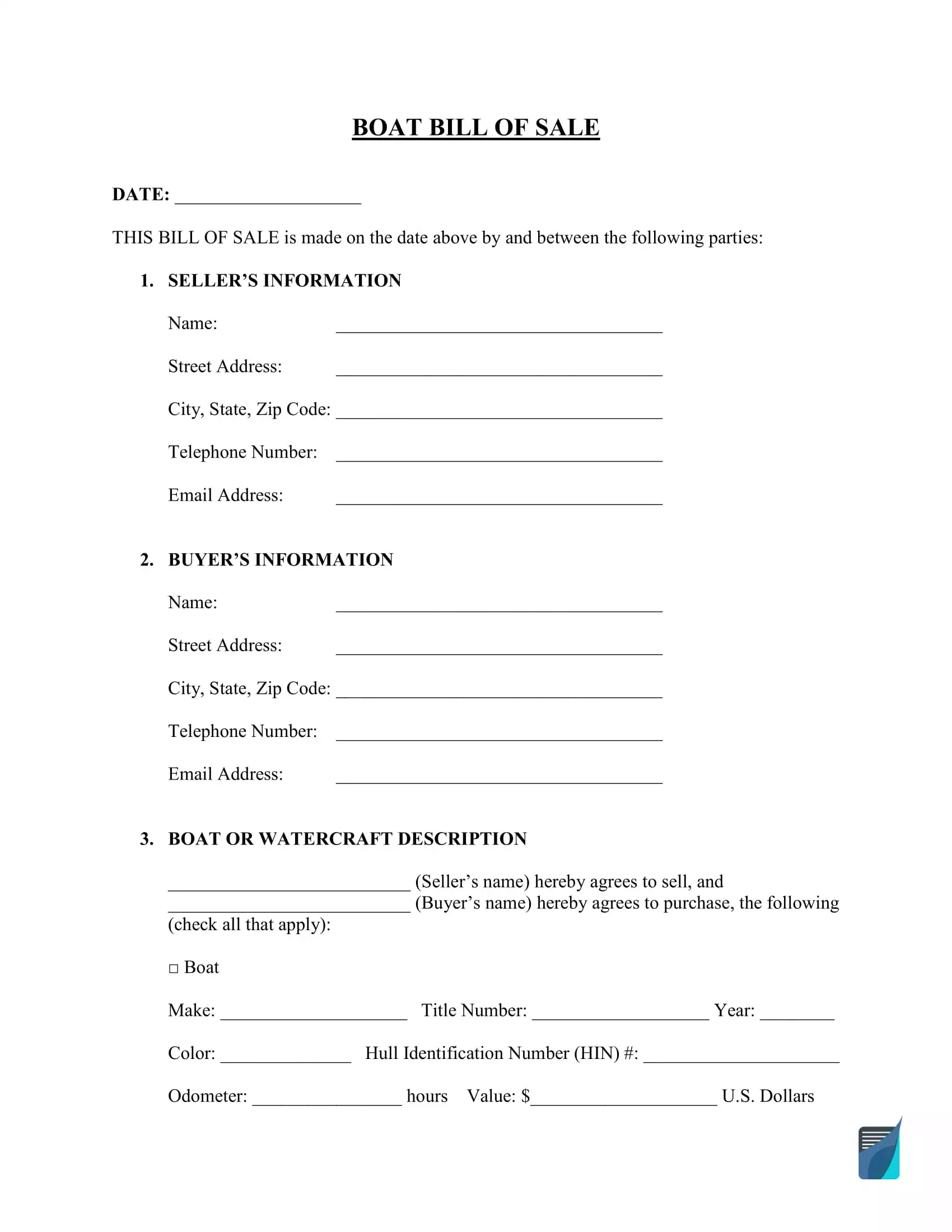

Free Florida Boat Bill Of Sale Form Pdf Formspal

Moonshine Too 29ft 2001 Blackman Yacht For Sale Macgregor Yachts

Boundary Waters Nordhavn 50 Boundary Waters Boat Water

New Cobalt Boats For Sale In West Palm Beach Vero Beach Fl Marine Connection

Spode Porcelain Harrogate Large Gravy Boat With Underplate Spodecopeland Spode Porcelain Spode Harrogate

Used Boats For Sale Newport Ri Used Boat Dealer

Do You Have To Pay Taxes If You Live On A Boat Yacht Management

Yamaha Center Console Boats For Sale Miami Fl Jet Boats

Fort Pierce Boat Company Sees Surge In Sales Looking To Hire

2022 Yamaha 252s Riva Motorsports Miami

Fl Sales Tax 60k Cap On Boat Repairs

Rising Tides The Economic Impact Of The Miami International Boat Show